WHO WE SERVE

Whether you operate within compliance markets, voluntary markets, or simply wish to showcase your commitment to sustainability, CVR Markets site is here to serve you. We cater to a wide range of sectors and industries, offering carbon bullion that is specific to various carbon footprint categories, including:

- Energy

- Transportation

- Residential and Commercial Buildings

- Industry

- Agriculture

- Forestry

- Water and Wastewater

By engaging with CVR Markets, you can access high-quality carbon credits tailored to your specific environmental impact areas. Our products are designed to empower individuals, companies, and organizations to offset their carbon emissions responsibly and contribute to a more sustainable future for all. Join us in our commitment to environmental stewardship and climate resilience through the purchase of carbon bullion that aligns with your sustainability goals.

The Carbon Markets

Energy

The energy sector plays a pivotal role in carbon emissions due to the combustion of fossil fuels for electricity generation, heating, and transportation.

Transportation

Transportation is a significant contributor to carbon emissions, primarily from fossil fuel-powered vehicles used for personal, commercial, and public transportation.

Residential and Commercial Buildings

Residential and commercial buildings are responsible for a considerable share of carbon emissions through energy consumption for heating, cooling, lighting, and appliances.

Industry

Industrial activities encompass a wide range of processes that contribute to carbon emissions, including manufacturing, production, and resource extraction.

Agriculture

The agriculture sector is a significant source of greenhouse gas emissions, primarily from livestock farming, fertilizer use, and land conversion.

Forestry

Forestry plays a crucial role in carbon sequestration and biodiversity conservation, making it essential for mitigating climate change.

Water and Wastewater

Water and wastewater management can contribute to carbon emissions through energy-intensive treatment processes, chemical use, and methane emissions from organic waste. Sustainable water management practices, wastewater treatment optimization, energy-efficient technologies, and resource recovery from wastewater can help reduce the carbon footprint of water-related activities and promote water sustainability in a carbon-constrained world.

Stocks of sustainable development projects, such as those in agriculture, energy, transportation, and industry, are available for trading at CVRM.

Must Read

To comprehend why our Kyotounit One Standard pricing stands as a distinctive solution and why trading on the CVR Markets serves as an ideal baseline for investing in carbon credits, it’s essential to grasp the daily, monthly, and yearly dynamic impacts of climate change. Embracing change and actively participating in solutions are vital steps in addressing the urgent need for climate action.

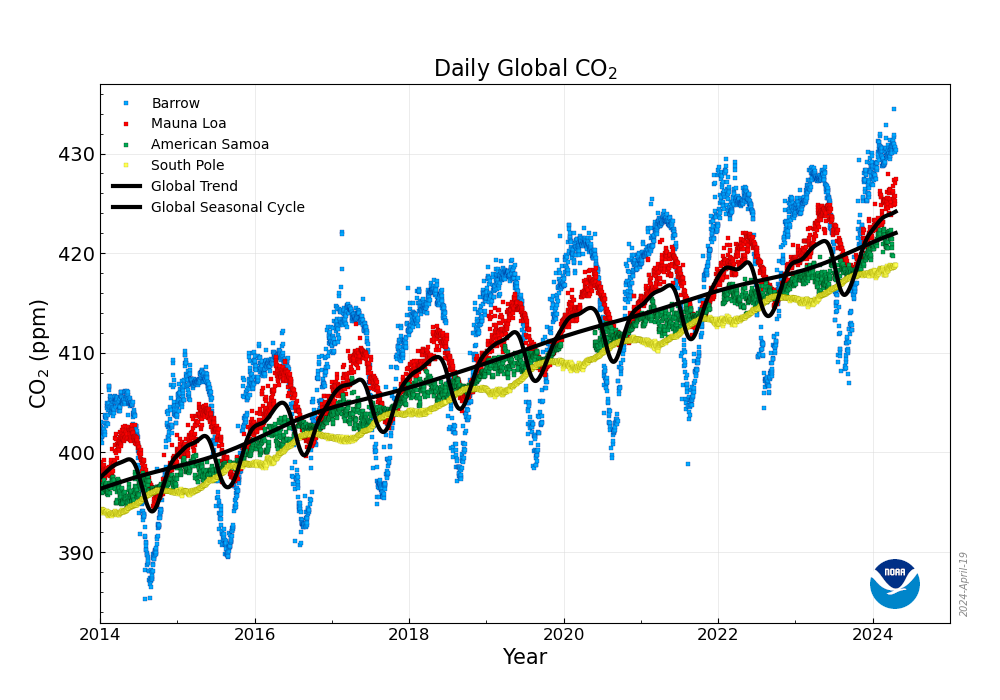

Global Trends in CO2

Powered By: Global Monitoring LaboratoryEarth System Research Laboratories The figure shows daily averaged CO2 from four

Trends in Atmospheric Carbon Dioxide (CO2)

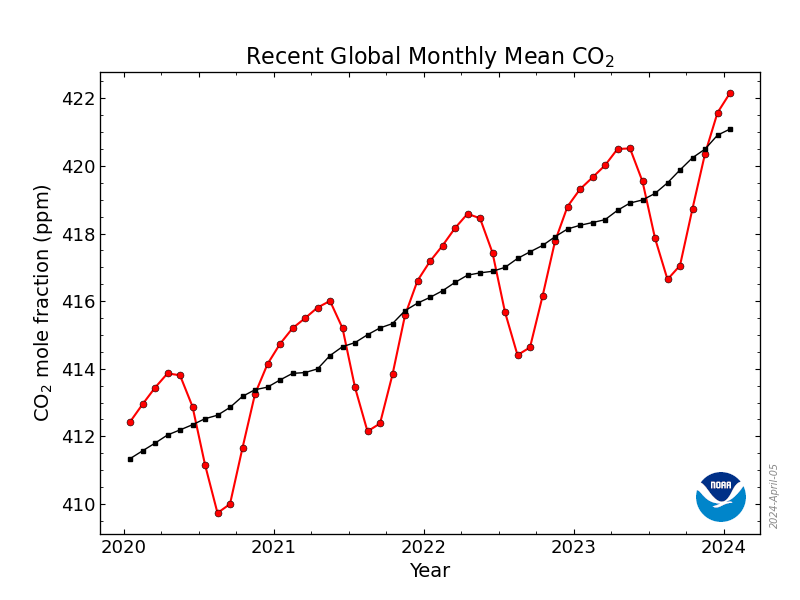

Global Monthly Mean CO2 Powered By: Global Monitoring LaboratoryEarth System Research Laboratories The graphs show

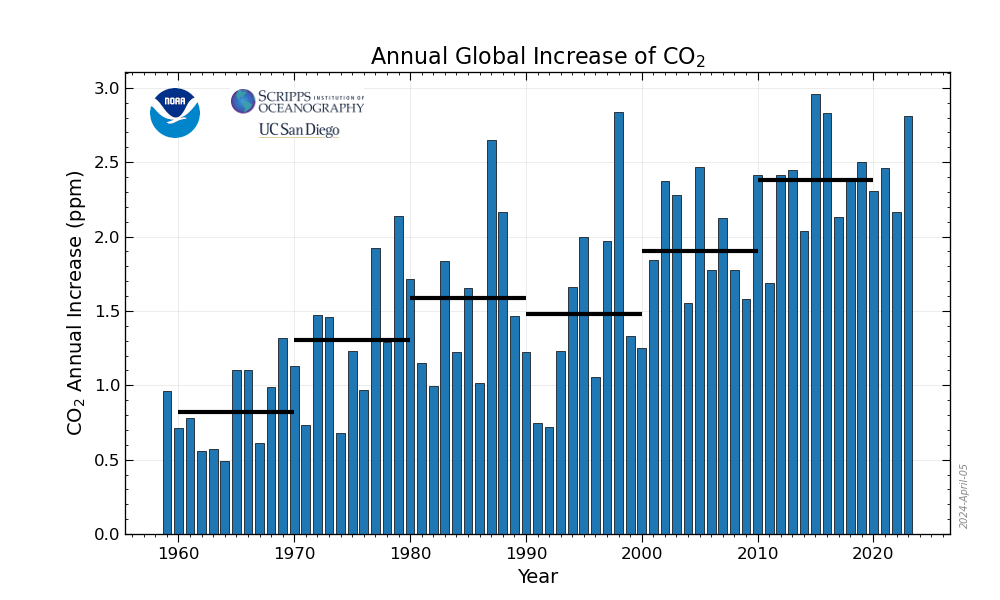

Annual Mean Global Carbon Dioxide Growth Rates

Global Trends in Atmospheric Carbon Dioxide (CO2). Powered By Global Monitoring LaboratoryEarth System Research Laboratories

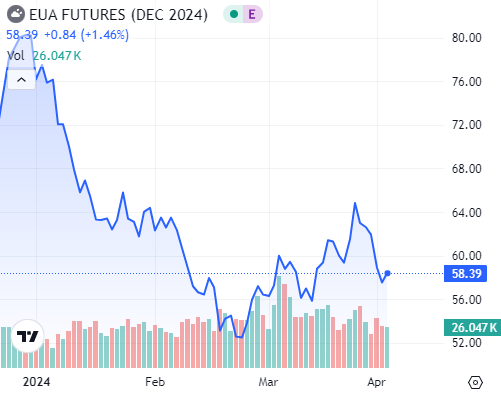

CVR Markets: Live Carbon Pricing

STEPS TO CVR (COMPLIANCE, VOLUNTARY, AND REGIONAL) MARKETS LISTING

CVR Markets, a service under Climate Markets Group, exerts oversight through its finance house division, necessitating that developers and emitters stem from accredited projects (voluntary or regulated). Investors are typically provided with a climate change ‘White Paper’ that delineates the potential of climate-related initiative investments, along with legal terms and conditions. Full transparency is a fundamental expectation for all investors involved.

Develop your White Paper with the goal of achieving Net Zero Carbon Dioxide (CO2) Emissions by 2050 in alignment with the Paris Climate Change Accord.

In recent years, investors have demonstrated a keen interest in investing based on their values.

Utilizing environmental, social, and governance (ESG) criteria enables the screening of investments according to corporate policies and promotes responsible corporate behavior.

ESG criteria can assist investors in mitigating potential investment losses.

Climate Markets Group is a UK & US-based climate financial market that offers price and liquidity data for nearly 8,000 climate initiative developers and emitters, enabling trading, transactions, and payments for environmental services. The company is headquartered in London and New York City. CVR’s climate market indexes and carbon trading services are divided into three markets: Compliance (CVRMX, CVRMD, CVRMU) and Carbon Offset Trading (COT), designed to educate investors on potential opportunities and risks.

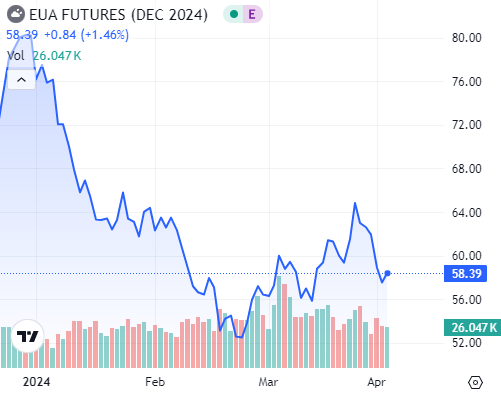

Mandatory Compliance Market Carbon Pricing

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

Mandatory Compliance Market Carbon Pricing

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

Aviation Industry Carbon Offset

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

China Price

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

New Zealand Spot Price

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

Voluntary Market Carbon Pricing

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

Mandatory Compliance Market Carbon Pricing

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

Aviation Industry Carbon Offset

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

China Price

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.

New Zealand Spot Price

Mandatory (Compliance) Market: Mandatory (compliance) markets are governed by national, regional, or provincial law and compel emission sources to meet GHG emission reduction targets. Because compliance program offset credits are generated and traded for regulatory compliance, they typically act like other commodity pricing. Data in the charts below is provided by Tradingview.